The Biden administration has forgiven $4.5 billion in student debt for 60,000 public service workers, raising questions about the long-term impact on taxpayers and the economy.

At a Glance

- $4.5 billion in student debt canceled for 60,000 public service workers

- Over 1 million public service workers have received debt relief under Biden

- Average student loan balance forgiven is approximately $70,000

- Republicans oppose the program and have attempted to block relief efforts

Biden Administration Expands Student Debt Forgiveness

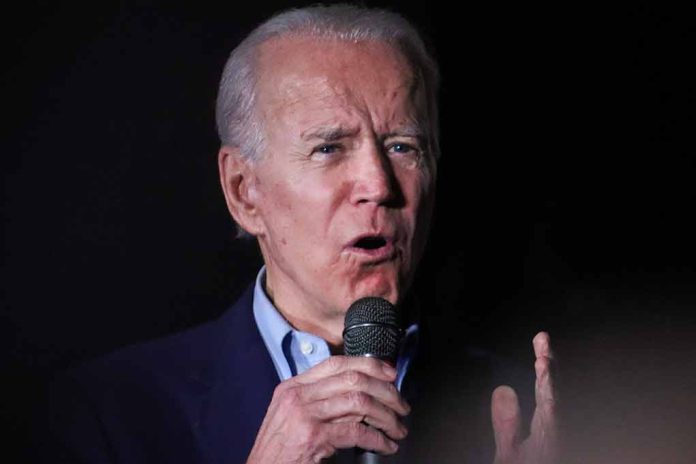

The Biden administration has taken another step in its controversial student debt forgiveness program, canceling $4.5 billion in loans for over 60,000 public service workers. This move is part of a larger initiative that has now provided debt relief to more than 1 million public service employees since Biden took office.

The Public Service Loan Forgiveness (PSLF) program, established in 2007, allows certain not-for-profit and government employees to have their federal student loans canceled after 10 years of service. However, the program faced significant issues with high rejection rates and technical disqualifications before the Biden administration’s reforms.

Today, my Administration approved student debt cancellation for over 60,000 public service workers – that means 1 million folks have now had their debt cancelled thanks to Public Service Loan Forgiveness on my watch.

I will never stop working to make higher education affordable.

— President Biden (@POTUS) October 17, 2024

Program Improvements and Expansion

Under Biden, the Education Department has relaxed requirements and improved program management. These changes have led to a substantial increase in the number of borrowers receiving relief. Before Biden’s presidency, only 7,000 people had received debt cancellation through the PSLF program.

“Public service workers – teachers, nurses, firefighters, and more – are the bedrocks of our communities and our country,” Biden said in a statement. “But for too long, the government failed to live up to its commitments.”

The administration has implemented several improvements to the PSLF program, including new regulations, simplified criteria, and opportunities for reconsideration of previous denials. The Limited PSLF Waiver allows public service workers affected by the pandemic to get PSLF credit for prior payments regardless of repayment plan or loan type.

Economic Impact and Opposition

The Council of Economic Advisers (CEA) highlights the economic benefits of student debt relief, including improved financial health and support for public service careers. However, the program has faced significant opposition from Republican officials who have attempted to block student debt relief efforts, including trying to end the PSLF program.

U.S. President Joe Biden Thursday canceled another $4.5 billion in student debt for more than 60,000 borrowers, bringing the number of public service workers who have had their student loans for higher education forgiven to over 1 million. https://t.co/7D1cVZRTqF

— NEWSMAX (@NEWSMAX) October 18, 2024

Critics argue that the debt forgiveness program unfairly shifts the burden to taxpayers who did not attend college or have already paid off their loans. They also contend that it could incentivize higher education institutions to raise tuition costs, knowing that the government may eventually forgive student debts.

Future of Student Debt Relief

The future of student debt relief remains uncertain as legal challenges continue. The Biden administration’s broader student loan forgiveness plan was struck down by the Supreme Court, but efforts to provide targeted relief through existing programs like PSLF continue. As the 2024 election approaches, student debt relief is likely to remain a contentious political issue, with potential impacts on voter sentiment and economic policy.

Sources:

- Biden cancels $4.5 bln in public workers’ student loans

- Biden forgives more student loans: 60,000 borrowers will get notices canceling $4.5 billion in debt

- FACT SHEET: President Biden Announces Over 1 Million Public Service Workers Have Received Student Debt Cancellation Under the Biden-Harris Administration